The value of your claim will be made up of two parts:

1. The value of your injury or combination of injuries – the amount to compensate you for your pain, suffering and how your life has been affected. What lawyers call ‘general damages’.

2. The extra expenses or loss of earnings caused by either the injury or the accident. What lawyers call ‘special damages’. This includes any property that got broken or damaged in the accident, any costs built up because you didn’t have access to the car or could not drive it because of your injuries.

The value of your injury – general damages

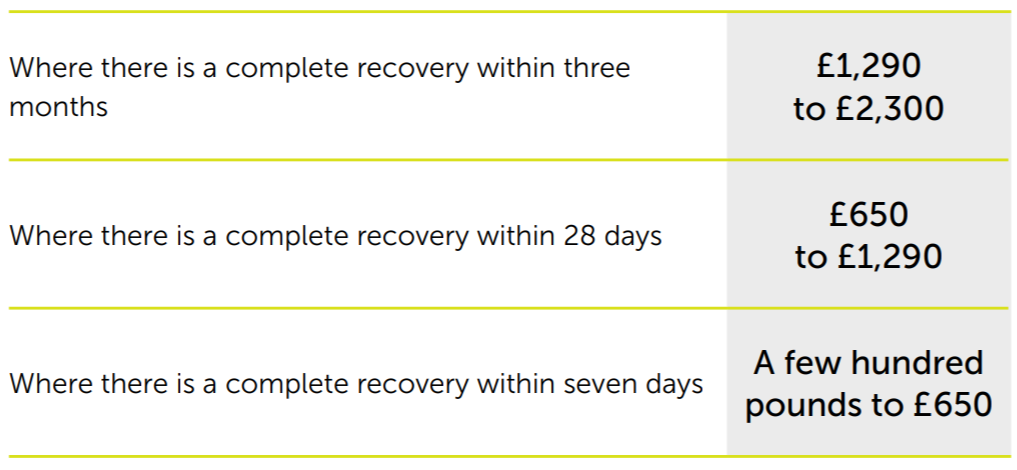

How much you can claim for your injuries depends on how serious the injuries are and how long it will take to get better.

Whiplash injuries

If your accident happened on or after 31st May 2021, there are set amounts for what you can claim for soft-tissue injuries to your neck, shoulder and back (which means injuries to the muscles, tendons or ligaments - often called ‘whiplash injuries’). These set amounts (which the law calls ‘whiplash tarrifs’) are low, many people think unfairly so. They are set out in the table below.

Which amount you get depends on how long the injury lasts. If following your accident you experience pain in two or more areas of your neck, shoulder and back, you count just the most severe. So, for example, if you have pain in your back which cleared up after 3 months and in your neck which is still ongoing six months later but your doctor expects it to improve soon, the correct amount would be the one for injuries that lasted 6-9 months. See our advice below about how to estimate how long your injuries will last.

If as well as having whiplash you have experienced shock or anxiety (what the law calls ‘minor psychological injury’), you can claim the amount in the second column.

| | Amount for ‘whiplash’ injuries to neck, shoulder, and back | Amount for ‘whiplash’ injuries to neck, shoulder, and back and ‘minor psychological injury’ like shock or anxiety |

| 0-3 months | £240 | £260 |

| 3-6 months | £495 | £520 |

| 6-9 months | £840 | £895 |

| 9-12 months | £1320 | £1390 |

| 12-15 months | £2040 | £2125 |

| 15-18 months | £3005 | £3100 |

| 18-24 months | £4215 | £4345 |

Some people can get a slightly higher amount for ‘whiplash’ injuries. If your injury was unusually severe or your circumstances increased the pain or difficulty caused, you can claim up to 20% more than the relevant amount in the table above. You need to explain how much extra you are claiming for when you start your claim, and explain what is exceptional about your case.

Your circumstances might count as ‘exceptional’ if for example, you were training for the London Marathon, and the injury meant you missed the race. Or if the injury meant you were unable to lift your disabled son as you need to be able to do to care for him properly.

It is often hard to know exactly what a judge would count as exceptional, but it is worth making an argument for an uplift on that basis if there is anything about your situation that made the injury worse than it would have been for most people. It may mean the other side’s insurer makes you a higher offer. If they don’t, you should think carefully about whether it would be worth going to court over.

Other types of injury

You might have been injured in other ways instead of, or as well as, getting ‘whiplash’ injuries to your neck, back and shoulders. Perhaps you hit and cut your head, bruised your knee, broke your wrist, or received more severe injuries.

There is a different way of valuing other types of injuries. When or if your case gets to court, the judge would set the amount of compensation for your injuries using something known as the ‘Judicial College Guidelines’. The easiest thing is to use these guidelines to estimate the value of your injury. You can find the relevant guidelines in the appendix of ‘Guide to Making a Claim’, starting on p53.

If you have two or more injuries that aren’t whiplash (for example, a bruised knee and broken wrist) the amount you will be offered in compensation will be an amount that combines the total – not one amount for your knee and another for your broken wrist.

We don’t yet fully know how judges are going to deal with cases where a person receives whiplash injuries and another type of injury, or injuries. It may be that the compensation amount will be an amount that combines the total as it is for other types of injury, or if it will be an amount for your whiplash and minor psychological injury, and another amount for your broken wrist, for example. Until we do, you should expect any offer you receive to offer an amount for your whiplash injuries and your other injury or injuries separately.

If you fully recover from the injury within months, you also need to look at the minor injuries section of the Judicial College Guidelines, starting on p53 of ‘Guide to Making a Claim’.

How to estimate how long your injuries will last

It is often hard to know how long injuries will last. The best thing to do is base your valuation on the length of recovery time that the doctor at the hospital, your GP or any other doctor you have seen about the injury has said. If it gets better quicker or slower than expected, you can change the amount you are claiming for at any point before you accept an offer. If the amount you can claim for increases so much that it takes you beyond the personal injury limit (£5,000 for accidents that happened on or after 31st May 2021, or £1000 for accidents before then), or the £10,000 total limit, your claim will simply get moved to another track (the fast-track or the multi-track). If this happens, you will be able to get advice and representation on a ‘no win, no fee’ basis. See Is it a small claim? and How to find a good personal injury lawyer above.

Anything that is expected to take more than 24 months to heal, or will never heal, will be valued at over £5000 – so will not count as a small claim (no matter when the accident occurred). See Is it a small claim? and How to find a good personal injury lawyer above.

Extra costs and loss of earnings – Special damages

You can also claim for any extra expenses or loss of earnings caused by the accident or your injury or injuries. These amounts don’t come under the personal injury limit (£5,000 for accidents that occurred on or after 31st May 2021 or £1,000 for accidents before that date). Instead they come under the £10,000 in total limit.

Extra costs

You can claim for any additional costs caused by either the accident or your injury, as long as you can prove that 1) you paid them and 2) they were caused by the accident or injury. The law calls these extra costs ‘losses’. You will need receipts or other proof of payment. For example, you can claim for prescription charges, or travel to or parking at hospital appointments connected to the injury. If you were unable to drive because of the accident and had to pay for taxi fares to get your children to and from school, you can add the costs of those to your claim. If your mobile phone or anything else was smashed in the accident and you had to buy a new one, you could claim for that. If you were unable to look after your children in the way you normally would, and had to pay for child care as result, you can add that to your claim. If you always use childcare for the same number of hours, you cannot add it to your claim as it was not a direct result of either the accident or the injury.

Loss of earnings

You can claim for the money that you lost if the amount you could earn was reduced, or if you could not work at all, because of your injuries. You can also claim if you were unable to work because your car was damaged. Again you will need to prove the amounts you lost and how long it lasted for – you could use your payslips or a letter from your employer if you have one, or your work schedule and bank statements (both of the time you couldn’t work and for comparative months when you could to show what you normally earn) if you are self-employed.

Costs associated with your car

There are two types of costs associated with your car and they are treated a bit differently:

- ones that you or a friend or relative has paid on your behalf (the law calls these ‘protocol costs’) and

- ones that another company paid on your behalf (the law calls these ‘non-protocol costs’)

Costs that you or a family member/friend has paid on your behalf are included in your claim. Again, you will need receipts or other proof of payment. They might be:

- the cost of car repairs

- the excess you had to pay on your car insurance

- the cost of hiring a car while yours was mended

- any vehicle recovery and storage charges.

To this figure, add the amount the car’s value has reduced as a result of the accident. You get this by taking the value of the car immediately before the accident occurred (look online for how much similar cars sell for), and subtracting the amount the car was worth after the accident. This is probably the writeoff value your insurer gave you.

Costs that a company has paid on your behalf, (for example, your insurer who paid for repairs to your car, or a credit hire organisation lent you a replacement car) cannot be included in your claim at this stage, but that company will have a right to claim costs from the other side’s insurer themselves when the case ends. If you need to go to court about how much compensation you should get, you do then add these costs to your claim.

Fees

You can claim back your court fees, or fees for a police report, medical records, medical report (if you had to pay for it) and for an expert whose report you need for your claim (up to a maximum of £750) at the end of your case, but you don’t include that in the valuation of your case at the start. So ignore that for now.

How to estimate the total value

We created the table below to help ensure that you don’t leave out any amounts that you may be entitled to. Don’t panic if you realise you have left something out, you can change the amount you are asking for at any time before you create the court pack.

Amount for | £ |

Whiplash, or Whiplash plus minor psychological trauma | |

Whiplash - Exceptional circumstances | |

Other injury or injuries (amounts taken from judicial college guidelines) | |

| |

Total for personal injury | £ |

| |

Loss of earnings | |

Cost of repairs to car (if you paid them yourself) | |

Excess to pay on car insurance | |

Cost of hiring a car | |

Vehicle recovery or storage charges | |

Other costs – for example, prescription charges, or travel to hospital, taxi fares for necessary journeys, replacement of any items damaged in the accident, extra childcare. Use a new line for each item. | |

| |

| |

| |

| |

| |

Total for extra costs | £ |

| |

Total for personal injury and extra costs | £ |

Remember – if your total for personal injury comes to more than £5000 (if your accident was on or after 31st May 2021, or £1000 if your accident was before then) or your overall total comes to more than £10,000, your claim is not a small claim. This means that you can get a lawyer to help you with your case and only pay for their help if you win. See Is it a small claim? and How to find a good personal injury lawyer.

If you think that your claim might be more than £5,000 for personal injury or is close to being more, we would suggest you take advice. See How to find a good personal injury lawyer and look for firms who will offer free initial advice.

If your accident was before 31st May 2021 and the amount of your claim was below £1000 for personal injury and under £10,000 in total, you can make a small claim using the old rules. See the other guides in the How to take a claim in the civil court series, particularly How to start a claim.

If your accident was on or after 31st May 2021, and the amounts came to £5000 or less for personal injury, and less than £10,000 in total, you must use the new Official Injury Claim service (sometimes called OIC or the Official Injury Claim portal). See next section for details.

For example, if you received minor cuts and bruising to your face which healed in 10 days and left no scar, you would look at the minor injuries section of the judicial college guidelines.

For example, if you received minor cuts and bruising to your face which healed in 10 days and left no scar, you would look at the minor injuries section of the judicial college guidelines.